The trend of cryptocurrency investments has increased significantly these days, but along with this trend, it’s also crucial to consider security. Investing in the world of cryptocurrency can be an exciting opportunity, but it also comes with risks. In this article, we will discuss how to protect your cryptocurrency investments to ensure that your investment remains safe and secure.

Basic Understanding of Cryptocurrency Investments

Before understanding cryptocurrency investments, it’s essential to have a basic understanding of what cryptocurrency is and how it works. Cryptocurrency is a digital currency that is secured through cryptography. It operates on a decentralized network, where there is no central authority. Popular cryptocurrencies like Bitcoin, Ethereum, and Ripple are part of this system.

Importance and Types of Wallets

Cryptocurrency wallets are essential for securing your digital assets. There are two main types of wallets: hot wallets and cold wallets. Hot wallets are connected to the internet and facilitate transactions but come with higher security risks. Cold wallets are offline and are considered more secure because they are not connected to the internet.

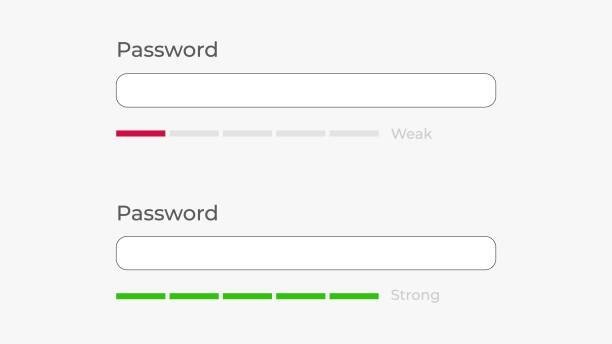

Strong Passwords and Two-Factor Authentication

To secure your cryptocurrency accounts, it is necessary to use strong passwords. Your password should be complex and unique. Additionally, enabling two-factor authentication (2FA) is very important. 2FA provides an additional layer of security that protects your account from unauthorized access.

Protection Against Phishing and Scams

Phishing and scams pose a threat to cryptocurrency investments. Through phishing attacks, hackers can steal your personal information or login details. To avoid this, you should stay away from suspicious emails and links. Always verify the authenticity of the source before clicking on any link.

Regular Updates and Software Maintenance

The software of your cryptocurrency wallets and exchanges should be updated regularly. Updates patch security vulnerabilities and introduce new features. Regular maintenance and updates keep your investment secure and protect against new threats.

Benefits of Diversification

Diversification is an important strategy that can protect your investments. Instead of locking all your investments in a single cryptocurrency, investing in different cryptocurrencies is safer. This way, if the value of one cryptocurrency falls, the impact on your overall investment will be less.

Backup and Recovery Plans

You should have backup plans for your cryptocurrency wallets and accounts. Backup is necessary to recover your funds if your wallet is lost or damaged. Recovery seed phrases and private keys should be stored in a safe place and not shared with anyone.

Exchange Security Practices

Security at cryptocurrency exchanges is also crucial. Use reliable and well-established exchanges that implement strong security measures. Regularly monitor the withdrawal and deposit options of the exchange and report any unusual activity.

Regulatory Compliance and Legal Aspects

Understanding the legal aspects and regulations of cryptocurrency investments is also necessary. Each country has its own regulations governing cryptocurrency transactions. Ensure that your investments are compliant with local laws and regulations to avoid future legal issues.

Security Audits and Monitoring

Security audits and monitoring are important for securing your cryptocurrency investments. Regular security audits identify vulnerabilities in your wallets and accounts and improve security measures. Monitoring tools also track your investments in real-time and detect suspicious activities.

Education and Awareness

Education and awareness about cryptocurrency and digital security are also essential. Staying updated on market trends and security threats keeps your investment secure. Regularly follow cryptocurrency news and updates and try to understand new developments.

Secure Internet Practices

Internet security practices also protect your cryptocurrency investments. Use secure websites and encrypted connections whenever performing cryptocurrency transactions. Avoid transactions on public Wi-Fi networks as these networks are unsecured.

Avoiding Unnecessary Risk-Taking

In cryptocurrency investments, it’s important to avoid unnecessary risk-taking driven by the lure of high returns. Investment decisions should be based on research and analysis, not just hype. Implementing risk management strategies is necessary to keep your investments secure.

Expert Advice and Consultation

If you are new to cryptocurrency investments or have doubts about a specific aspect, seeking expert advice and consultation is crucial. Financial advisors and cryptocurrency experts can help make your investments secure and profitable. Professional guidance will assist you in making the right decisions.

Future Trends and Adaptation

It is also important to follow future trends in cryptocurrency and digital security. Technology evolves rapidly, and new threats also emerge. Adapting your investment strategies and security measures to updated trends ensures long-term investment security.

Security in cryptocurrency investments is an ongoing process. Regular updates, strong security practices, and informed decisions keep your investments protected. Hopefully, these tips will be helpful in securing your cryptocurrency investments.